At Achieve, we're committed to providing you with the most accurate, relevant and helpful financial information. While some of our content may include references to products or services we offer, our editorial integrity ensures that our experts’ opinions aren’t influenced by compensation.

Personal Loans

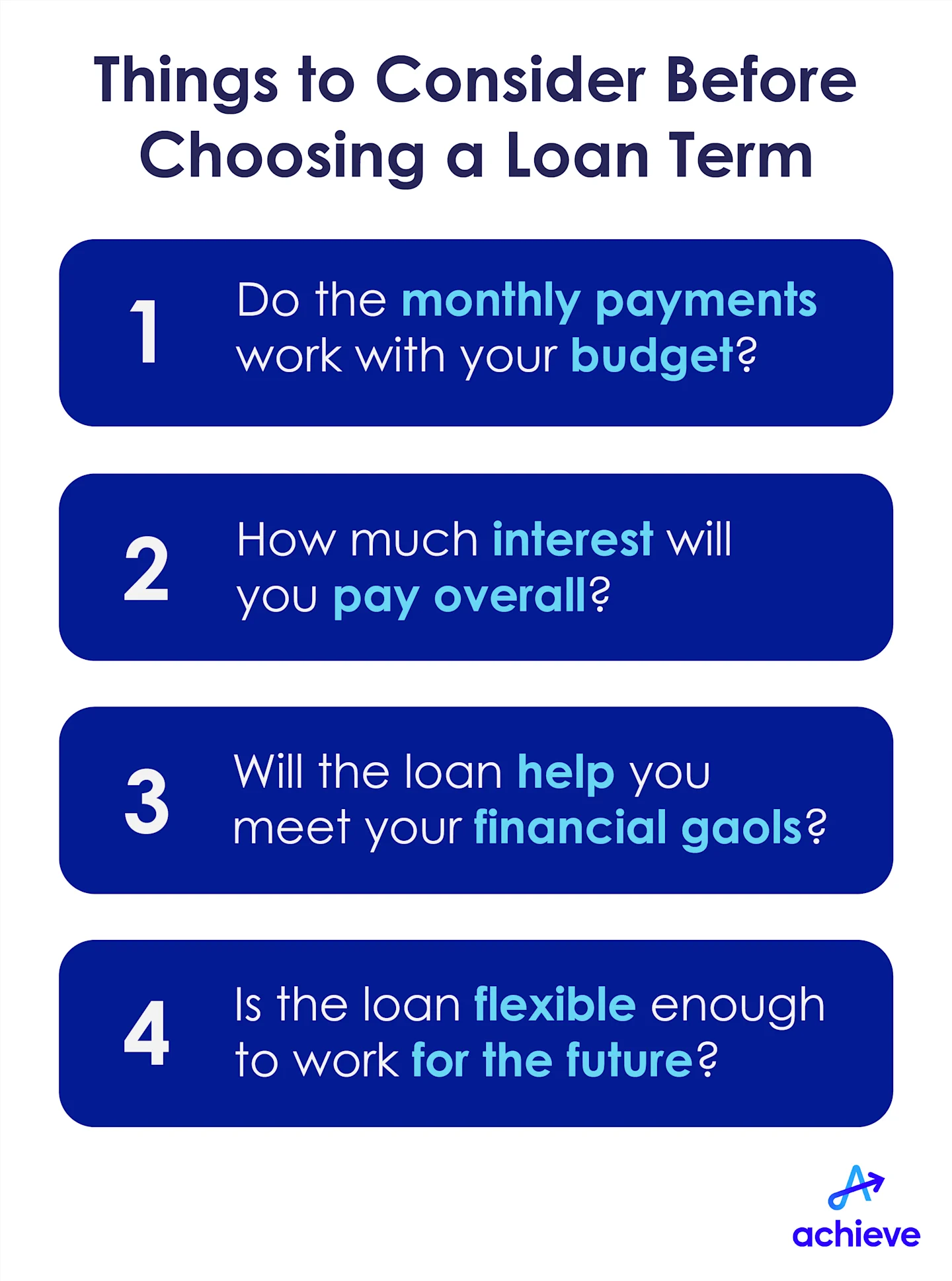

4 things to consider before choosing your loan term

Dec 25, 2025

Written by

Reviewed by

Key takeaways:

Start with how much you can afford to pay monthly.

Longer terms generally have smaller monthly payments.

Shorter terms help you save on interest costs.

Choosing a personal loan term can feel confusing. You want payments you can handle and a rate that doesn’t add extra stress—and sometimes those goals pull in different directions.

When you understand how each part of a loan affects your budget, it becomes much easier to choose a term that supports your goals and keeps your payments manageable. Your ideal loan term is the one that works for you and the way you live.

Choosing a loan term isn’t one size, fits all, but taking a look at the costs and your own circumstances. We’ll take you through a simple, four-step outline that points you in the right direction.

1. Your monthly budget

Start by calculating what you can comfortably afford each month. If you know you could only comfortably pay $200 a month, then you’ll be able to quickly pass by loans with higher monthly payment requirements.

Typically, a longer loan term makes monthly payments smaller. You can usually lower your payments by choosing a longer term. A monthly payment on a two-year loan might drop from $200 a month to $139 a month with a longer, three-year term.

You’ll typically make two concessions for lower monthly payments. First, your loan sticks around longer. Second, longer loans often cost more thanks to additional interest fees. That’s why you might go for a shorter term, despite the higher monthly payments.

Be realistic about what you can afford. One easy way to figure this out is to write down how much money you have coming in vs. how much goes out. Try a simple two-column budget—one column for income and the other for expenses. You should be able to work out how much unspent cash is available. (If you don't have an emergency fund, it's smart to leave some padding for unforeseen expenses.)

Another way to gauge what you can afford is to consider your debt-to-income (DTI) ratio. DTI is how much debt you have relative to your income. If your monthly debt payments add up to $300, and your monthly income is $1,000 (before taxes), your DTI is 30%. Experts recommend keeping your below 35%. A lower DTI makes it easier to handle contingencies.

How do I choose the best personal loan term?

Start with what fits your budget and goals. Shorter terms cost less in total interest but have higher monthly payments. Longer terms are easier month-to-month but cost more overall.

2. Total interest cost

Longer loan terms are often more expensive because of the extra interest fees. Even a few extra payments could add up to a significant amount of interest. For that reason, you might not accept the longest terms offered to you. We’ll illustrate just how quickly interest can add up.

Say you borrow $1,000 at a 12% rate. Here’s what the interest could cost you for various loan terms:

Term | Interest cost (total) |

2 years | $129.76 |

3 years | $195.72 |

5 years | $334.67 |

In the longest term, you’d pay $1,334.67 for a $1,000 loan.

In general, you want to keep interest costs as low as possible. The trick is to balance shorter terms with affordable monthly payments. Start with the monthly payments—what you can afford to comfortably pay on a regular basis—and then work from there..

Many lenders will let you make extra payments on loans without charging you a fee. This gives you the flexibility to pay your loan early if your situation improves. Doing so could shrink your total interest cost.

Pro tip: Call your loan servicer and tell them you want your extra payments to service the loan principal.

Does the term of my personal loan affect the interest rate?

Yes. Shorter loan terms often come with lower interest rates because lenders take less risk. Longer terms could mean higher total interest costs.

3. Your financial goals

Think about your loan term options in the context of your financial goals. That might be debt consolidation, credit building, or home improvement.

Two questions to ask:

What loan term is best for my financial goals?

Which loan term will help me become debt-free?

If you're consolidating debt, you might prefer a longer term that keeps your payments low so you can work on getting your finances back on track.

Building credit? You might prefer a shorter term that costs you less interest as you work to build up your credit score with on-time payments.

Spend some time on this. The more you pin down your answers, the better you’ll understand how to best reach your financial goals.

4. Your future plans

Life’s uncertain, and things change. Maybe the Federal Reserve lowers interest rates, giving you an opportunity to refinance your personal loan. Your kid breaks a leg, and you’ve got an unexpected medical bill. Not to worry, you’re not locked into your current plans.

The tradeoff is time versus money.

Longer loan terms could give you more flexibility, since the typically lower payments could free up cash for other things, like paying down other debt or saving an emergency fund. Over the life of your longer term, though, you’ll pay more in interest.

A shorter loan term typically means you pay off your loan faster and cheaper. The money you save on interest could help you save for emergencies, while the shorter term means you're free of your loan debt sooner and can focus on other financial goals.

When it comes to choosing a loan term, you want one that fits into your life. Choose the option that best suits your needs—now and in the future.

What’s next: Choose your term with confidence

There’s no wrong choice. Your financial life is yours alone, so choose the term that fits your budget and your goals. You can’t know exactly how your finances will look down the road, so the smartest move is to take out a loan thoughtfully. Jot down some of your thoughts to make sure you understand:

The terms

What you can realistically afford

How the loan might fit into your life if your income, expenses, or priorities shift

You’re not expected to predict the future, just to make a careful, informed choice today that won’t box you in tomorrow.

Slough off some of the uncertainty by prequalifying for loans. You can compare:

Rates

Terms

How different terms affect loan payments and total interest

Get started with a quick quote on your personal loan options—and bring your checklist. That way you’ll have the information you need to choose loans that help you meet your goals.

Author Information

Written by

Cole is a financial writer. He’s written hundreds of useful articles on money for major personal finance publications. He breaks down complicated topics, like how credit cards work and which brokerage apps are the best, so that they’re easy to understand.

Reviewed by

Jill is a personal finance editor at Achieve. For more than 10 years, she has been writing and editing helpful content on everything that touches a person’s finances, from Medicare to retirement plan rollovers to creating a spending budget.

Related Articles

There are minor differences between a co-signer and a co-applicant and co-borrower. Both can help save money. Learn the pros and cons of using a co-signer on...

Use a personal unsecured loan from Achieve, with no collateral, to consolidate high-interest rate debt, make home improvements, or fund a large purchase. Apply now.

Obliterate your high interest credit card debt with a low interest personal loan and get out of debt faster. Our expert tells you how.